DO WE REALLY NEED SEA LINK?

National Grid says it's essential to handle future electricity demands, but we argue their reasons are based on outdated information and exaggeration.

There are cheaper, less damaging ways to achieve the same goals without trenching protected areas.

Our Main Arguments

The "Need" is Overstated: National Grid claims there's a big shortage of electricity capacity (up to 7 GW by 2037), but this relies on old assumptions about other projects that have changed or aren't approved yet. Without those, there's actually enough power available through existing upgrades and smart management.

Better Options Exist: We can upgrade current power lines or use other sites at a fraction of the cost (less than 20%), avoiding new construction in sensitive areas.

Recent Updates (February 2026): Recent hearings highlighted concerns from locals and experts about combined impacts with other projects. Contracts have been signed assuming approval, but key changes (like a project moving locations) haven't been addressed.

What We Want: A review of the planning independently, or at the least a planning hearing on the needs case and focus on smarter alternatives.

Problems with the Project's Justification

National Grid's case for Sea Link is built on predictions of huge power shortages, but these don't hold up when you look closely.

Exaggerated Shortages: They say there's a 1,852 MW deficit near Sizewell and a 6-7 GW gap in the southeast by 2037. But this includes projects like Nautilus (moved away in November 2024) and LionLink (not yet approved, with consultations ongoing until March 2026). Remove those, and there's actually a surplus of power.

Outdated Data: Their reports use old forecasts. Newer ones from the National Energy System Operator (NESO) in 2025 show that ongoing upgrades (like reconductoring lines between Tilbury and Grain) and tools to manage power flow (like intertrips that can handle over 900 MW) are enough.

Artificial Issues from Imports: The UK often has extra power, but international cables import electricity anyway due to market prices, creating fake bottlenecks. Better management could turn these into exports, fixing the problem without new builds.

Demand Isn't That High: Power use in Kent and the southeast is growing, but not as fast as predicted, and can be handled by improvements to existing systems.

No Rush: Any real shortages won't hit until after 2035, giving time for better technology to evolve.

Smarter and Cheaper Alternatives

Sea Link isn't the most efficient or cost-effective choice. Here are better options that provide the same benefits without the downsides:

Upgrading Existing Lines: Using advanced materials to "reconductor" current power lines can double their capacity quickly and cheaply. For example, upgrading the Sizewell to Bramford line (about 55 km) could cost under £200 million, compared to Sea Link's £1.2-1.5 billion for just the Kent parts. Similar upgrades are already happening elsewhere.

Non-Construction Fixes: Use software and services to balance power (like the Constraint Management Intertrip Service), add more battery storage (over 2.5 GW available), and adjust international cables to export instead of import.

These alternatives are proven in the US and Europe, costing 50-75% less and taking months, not years.

Issues with Rules and Transparency

There are conflicts and shortcuts in how this is being handled:

Biases in Planning: National Grid groups control much of the process, potentially inflating the need to benefit their other projects like LionLink.

Ignoring Changes: Key updates, like Nautilus moving, haven't led to revisions. Hearings in January 2026 exposed errors, like mispublished documents.

Risky Funding: Regulators approved early funding (£1.2 billion) in November 2025 without considering these issues, which could waste public money.

Costs to You: The £2.5 billion project would raise energy bills by about £108 per year, with little real benefit compared to cheaper options.

Key Technical Data Backing Our Claims

To support our arguments, here's a breakdown of key numbers from official sources like National Grid's application, NESO's Electricity Ten Year Statement (ETYS 2024, published January 2025), and Ofgem decisions.

We've simplified the data into a table for clarity. These figures show how the claimed shortages are overstated and how alternatives can cover needs without Sea Link.

Sizewell Group Deficit

Value: 1,852 MW (reduces to 352 MW without unconsented LionLink)

Explanation: The claimed shortage near Sizewell collapses when removing speculative projects like Nautilus (relocated November 2024) and LionLink.

Source: NGET's APP-320 Strategic Options Back Check Report (March 2025)

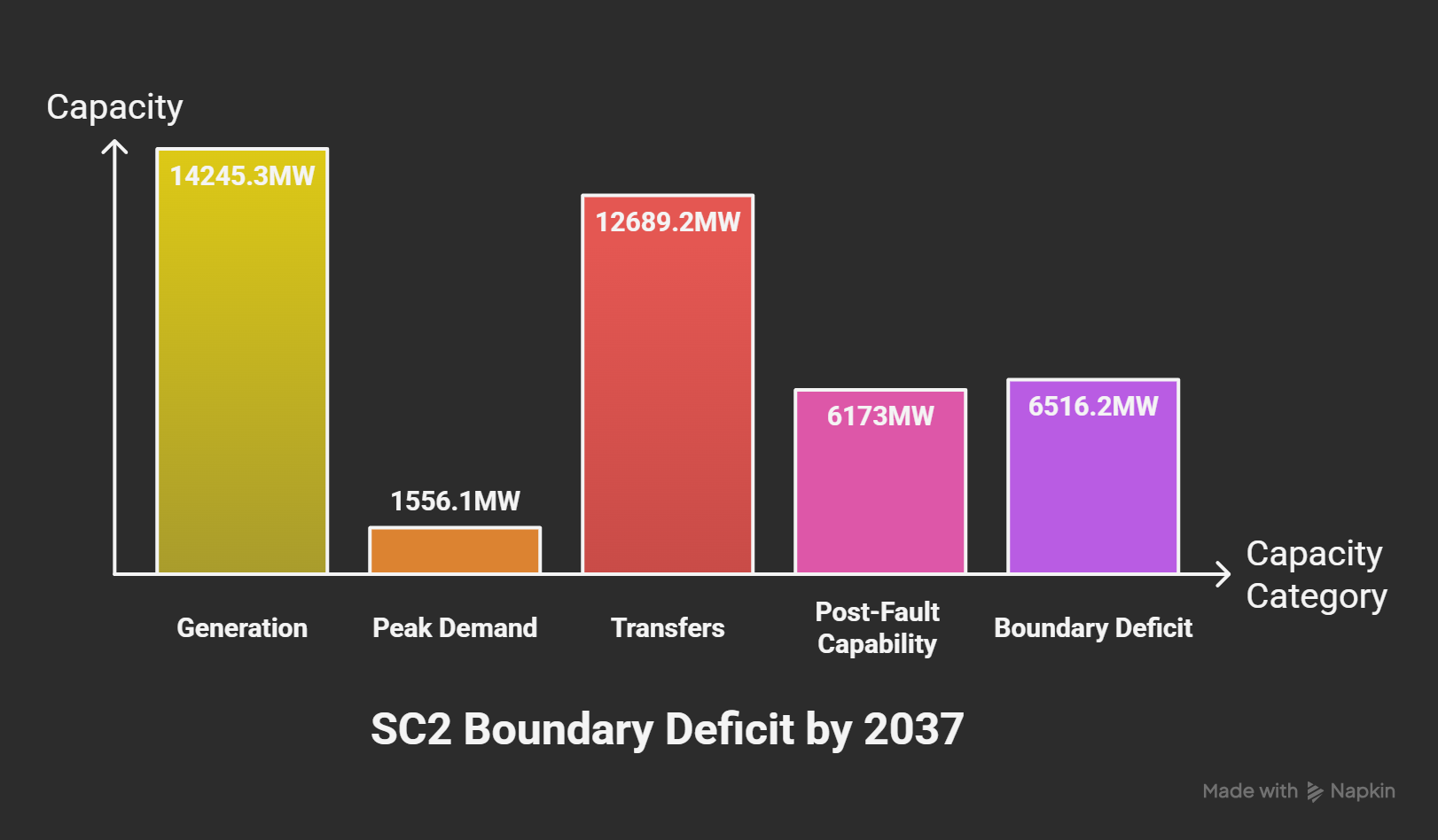

SC2 Boundary Deficit by 2037

Value: 6,516.2 MW under N-1 faults

Explanation: Based on 14,245.3 MW generation, 1,556.1 MW peak demand, and 12,689.2 MW transfers; post-fault capability is ~6,173 MW.

This deficit is mitigated by interconnectors and storage.

Source: NGET's APP-320; ETYS 2024 confirms similar post-fault limits (e.g., 6.7 GW thermal on Grain-Tilbury for related SC3 boundary)

East Anglia (EC5/EC5N) Capability

Value: 3.3-3.8 GW

Explanation: Voltage-limited but sufficient for flows without Sea Link ; no persistent shortfall beyond 2030.

Source: NESO ETYS 2024

South East (LE1) Limits

Value: 3.8-10.2 GW

Explanation: Voltage-manageable; capabilities meet Future Energy Scenarios (FES) without major new builds like Sea Link.

Source: NESO ETYS 2024

Interconnector Capacity in Kent

Value: 5+ GW (e.g., ElecLink, IFA, Nemo)

Explanation: Can export 4-11 GW flexibly, reducing artificial constraints from imports (~£1.8 billion in 2024/25).

Source: NESO ETYS 2024 and system reports

Storage Availability

Value: 2.5+ GW

Explanation: Helps mitigate deficits through flexible operations; combined with interconnectors, this creates a ~1,734.8 MW surplus (calculation: 6,516.2 MW deficit - 5,720 MW interconnectors - 2,531.2 MW storage).

Source: NESO ETYS 2024 and FES 2024

Upgrades (e.g., Tilbury-Grain/TKRE)

Value: Boost to ~8-9 GW pre-fault, ~6.7 GW post-fault

Explanation: Targeted for 2028; resolves thermal issues without Sea Link.

Source: NESO ETYS 2024

Constraint Management (CMIS)

Value: 900+ MW contracted

Explanation: Enduring intertrip service handles shortfalls until 2026 and beyond.

Source: NESO reports and ETYS 2024

Project Cost

Value: £2.5 billion total

Explanation: Early Construction Funding (ECF) approved at 27% of costs (November 2025); consumer bills could rise £108/year.

Source: Ofgem ECF Decision (November 2025)

Reconductoring Cost Savings

Value: <20% of Sea Link (£200 million for Sizewell-Bramford)

Explanation: Doubles line ratings; 50-75% cheaper than new HVDC.

Source: US/EU precedents and NESO ETYS 2024